Interest rate trends significantly affect property ownership by influencing borrowing costs and long-term financial strategies. Global economic shifts and central bank actions drive these trends, impacting mortgage requirements. Homeowners should monitor market dynamics, creditworthiness assessments, and borrower requirements to make strategic decisions regarding purchasing or refinancing for optimal long-term financial management. Staying informed ensures access to favorable financing options and protects property investments.

Interest rates are a cornerstone for property owners, influencing everything from mortgage affordability to home value. Understanding interest rate trends is thus paramount for making informed financial decisions. However, navigating these fluctuations can be challenging, with market forces and economic indicators constantly at play. This article provides trusted content detailing interest rate trends, offering clear insights into their drivers, cycles, and implications for homeowners. By the end, you’ll be equipped to confidently chart your financial course in this dynamic landscape.

Understanding Interest Rates: Basics for Property Owners

Interest rates are a fundamental aspect of property ownership, influencing borrowing power and long-term financial strategies. Understanding these trends is crucial for homeowners looking to navigate the market effectively. When considering a loan, interest rates determine the cost of borrowing money to purchase or refinance a property. They are essentially the price borrowers pay for access to capital over a set period.

The current interest rate trends play a significant role in shaping borrower requirements. In recent years, global economic shifts have led to varying interest rate landscapes. For instance, central banks’ responses to inflation have resulted in rate hikes, making borrowing more expensive. This trend impacts property owners seeking mortgages, as lenders often adjust their rates based on market conditions. When interest rates rise, monthly payments for existing borrowers may increase, affecting their overall budget and financial flexibility.

Property owners should stay informed about these trends to make informed decisions. Lower interest rates can stimulate the real estate market by encouraging borrowing and investment. Conversely, higher rates may cool down a heated market as affordability concerns arise. For those planning to buy or refinance, understanding how interest rate trends affect borrower requirements is essential. This knowledge enables homeowners to time their purchases strategically, lock in favorable rates, and manage their finances more effectively over the long term.

Tracking Market Trends: What Influences Mortgage Rates

For property owners, understanding interest rate trends is crucial to making informed decisions regarding their mortgages. Market dynamics play a significant role in dictating these trends, with various factors influencing mortgage rates. One key aspect is inflation, which typically drives interest rates higher over time. Central banks often adjust rates as an economic safety net, aiming to control inflation and maintain stability. For instance, during periods of rapid price growth, central banks might increase rates to cool down the market, whereas slowing economies could prompt rate cuts to stimulate borrowing and spending.

Another essential factor is the overall health of the housing market itself. When demand exceeds supply, rates tend to climb as lenders recognize a higher risk in providing mortgages. Conversely, a buyer’s market with ample inventory may lead to more favorable interest rate trends for borrowers. Additionally, borrower requirements and creditworthiness impact mortgage rates. Lenders assess credit history, debt-to-income ratios, and down payment amounts to determine risk levels, which directly influence the interest rates offered.

Understanding these trends allows property owners to be proactive. Monitoring market indicators and economic forecasts can provide insights into future rate movements. Adjusting one’s financial strategy accordingly—such as locking in a lower rate when predicting rising trends or considering adjustable-rate mortgages (ARMs) for potential rate drops—can be beneficial. Staying informed about interest rate trends borrower requirements is not just about securing a loan; it’s about navigating the market to ensure long-term financial health and peace of mind.

Strategies to Lock in Lower Rates: Protecting Your Investment

For property owners navigating today’s dynamic market, understanding interest rate trends is paramount to safeguarding investments. Lower rates offer a significant opportunity for cost savings, making it crucial to employ strategies that lock in these favorable conditions. One of the most effective methods involves proactive management of borrower requirements.

By closely monitoring interest rate trends, homeowners can time their refinancing efforts optimally. For instance, if long-term rates begin to rise, but short-term rates remain relatively stable, refinancing a 30-year mortgage for a shorter term could be beneficial. This approach leverages the lower rates while mitigating the risk of future increases. It’s essential to work with a reputable lender who can provide insights into these trends and tailor solutions suited to individual circumstances.

Moreover, maintaining a strong credit profile is critical. Credit scores play a significant role in determining interest rates. Regularly reviewing credit reports for errors or discrepancies allows borrowers to address them promptly. Maintaining a low debt-to-income ratio also enhances one’s borrowing power and opens doors to better rate offers. Staying informed about borrower requirements and adapting strategies accordingly ensures that property owners can take advantage of favorable interest rate trends, ultimately protecting their investment.

Forecasting Future Trends: Preparing for Rate Changes

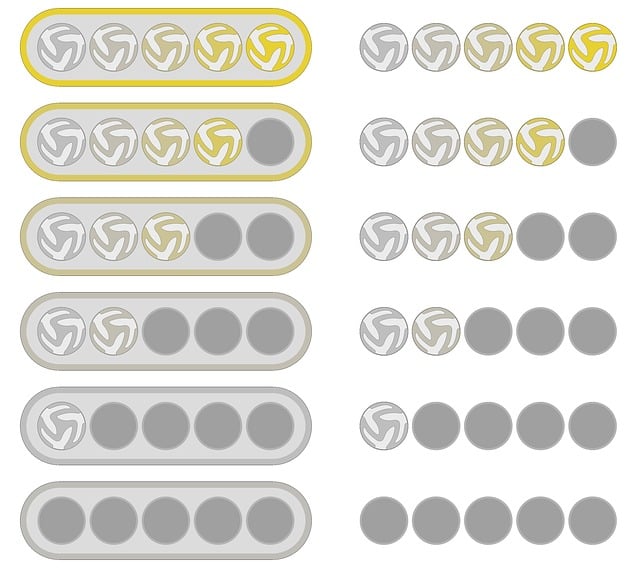

Predicting future interest rate trends is a critical aspect of responsible property ownership. Understanding these fluctuations allows borrowers to prepare financially for changes in mortgage rates, potentially saving significant amounts over the life of their loan. While precise forecasting is challenging due to various economic factors, historical data offers valuable insights into how rates typically evolve. Over recent decades, interest rate trends have shown a general pattern of ebb and flow, influenced by monetary policy, inflation, and global economic conditions.

For instance, in periods of robust economic growth and rising inflation, central banks often increase interest rates to curb spending and borrowing, while during economic downturns or recessions, they tend to lower rates to stimulate the economy. As a property owner, being aware of these cyclical patterns can help you anticipate potential rate hikes or declines. When interest rates are expected to rise, borrowers may opt to lock in their mortgage rate early to secure a lower long-term cost. Conversely, during periods of anticipated rate cuts, refinancers might choose to extend their loan terms to take advantage of more affordable borrowing costs.

Interest rate trends also have a direct impact on borrower requirements. As rates fluctuate, lenders adjust their eligibility criteria, affecting credit scores needed for approval and the range of loan products available. For example, during periods of high interest rates, lenders may tighten their standards, requiring higher credit scores from borrowers. Property owners should stay informed about these shifts to ensure they maintain a good credit standing and meet evolving borrower requirements, ensuring continued access to favorable financing options.